18+ Fannie and freddie

The Federal Housing Finance Agency FHFA today announced the conforming loan limits CLLs for mortgages to be acquired by Fannie Mae and Freddie Mac the Enterprises in 2022. However borrowers with loans backed by Fannie Mae or Freddie Mac are eligible for 18 months of total forbearance as long as they were in an active forbearance plan by February 28 2021.

Mis 3090 It For Financial Services Real Estate And It August 27 Ppt Download

We need the house price data through September 2022 to calculate the conforming loan limit for 2023.

. According to the Annual Report to Congress filed by the Federal Housing Finance Agency over a span of 37 years from 1971 through 2007 Fannie Maes average annual loss rate on its mortgage book was about four basis points. The GSE business model has outperformed any other real estate business throughout its existence. Government entities held or guaranteed 192 million or 27 trillion of such mortgages total.

The action was one of the most sweeping government interventions in private financial markets in decades. The Best Jumbo Mortgage Rates for 2022. The matters pertaining to this subject have been discussed in three preceding videos posted at LRC one two threeGeneral Edwin A.

Dodd is a Connecticut native and a graduate of. If you think you may have been a victim of a scam and your concerns with Fannie Mae Freddie Mac or a Federal Home Loan Bank involve fraud please contact the FHFA Office of Inspector General FHFA OIG at 800-793-7724 or visit the FHFA OIGs website. American Family News formerly One News Now offers news on current events from an evangelical Christian perspective.

What does it mean for the market. The Federal National Mortgage Association FNMA commonly known as Fannie Mae is a United States government-sponsored enterprise GSE and since 1968 a publicly traded companyFounded in 1938 during the Great Depression as part of the New Deal the corporations purpose is to expand the secondary mortgage market by securitizing mortgage loans in the. Coffee shop employee jumps for joy as he receives first paycheck.

Were providing an 18-month transition period from the time of publication to allow lenders and their vendors to. Paulson appearing at the same press conference stated that placing the two GSEs into. How personal financial management solutions might reshape consumer access to mortgage lending.

Fannie Mae Freddie Mac change landscape for condominium sales- The collapse of the Champlain Towers South Condominiums in Florida known colloquially as the Surfside Condos which took 98 lives has forever changed the way we look at condominium developments especially since it could have been preventedThe. This quarterly data will be released in late November. New Fannie Mae Directive.

Fannie Mae and Freddie Mac - Understanding Your Options Webinar Fundamental Differences in Fannie Mae and Freddie Mac Review S-Corporation - Form 1120S and 1040 with W2 and K1. Fannie Mae and Freddie Mac buy mortgages from lenders to hold or repackage as mortgage-backed securities. A Democrat Frank served as chairman of the House Financial Services Committee from 2007 to 2011 and was a leading co-sponsor of the 2010 DoddFrank ActFrank a resident of Newton Massachusetts.

By 2009 Fannie Mae Freddie Mac and FHLB financed 90 of new mortgages. Social Media Marketing Learn when and why social media can benefit your business including tips on driving lead generation. These reports are related to Fannie Maes and Freddie Macs activities to meet their mission and the.

This update includes both Fannie MaeFreddie Mac uniform instruments and Fannie Mae-specific instruments. Lenders may begin using these updated forms immediately July 2021 and are required to use them for loans with note. Find out about mortgage relief programs during COVID-19.

Our experienced journalists want to glorify God in what we do. The plan is funded mostly from the EESAs 700 billion financial. On September 7 2008 FHFA director Lockhart announced he had put Fannie Mae and Freddie Mac under the conservatorship of the FHFA.

Effective June 1 2021 Fannie Mae implemented requirements applicable to certain employees applying for employment or seeking personal business opportunities with Fannie Mae counterparties. Barnett Frank born March 31 1940 is a former American politician. There are a variety of 3-percent-down mortgage programs available via Fannie Mae and Freddie Mac.

Christopher John Dodd born May 27 1944 is an American lobbyist lawyer and Democratic Party politician who served as a United States senator from Connecticut from 1981 to 2011. Fannie Mae Freddie Mac could see a big loan limit jump. Dodd is the longest-serving senator in Connecticuts historyHe served in the United States House of Representatives from 1975 to 1981.

On February 18 2009 US. Walker was the only US. Currently we only have data for Q1 2022 for the quarterly index up 175 from Q1 2021 and the Purchase-Only index was up 183 through May 2022.

He served as a member of the US. Along with the Federal National Mortgage Association Freddie Mac buys mortgages. President Barack Obama announced a 73 billion program to help up to nine million homeowners avoid foreclosure which was supplemented by 200 billion in additional funding for Fannie Mae and Freddie Mac to purchase and more easily refinance mortgages.

All this is pure. Introduction Under the direction of the Federal Housing Finance Agency FHFA Fannie Mae and Freddie Mac the GSEs havedeveloped the Uniform Mortgage Data. The FHLMC was created in 1970 to expand the secondary market for mortgages in the US.

This communication relates to the Uniform Mortgage Data Program an effort undertaken jointly by Fannie Mae and Freddie Mac at the direction of the Federal Housing Finance Agency. Watch Out for Junk Mortgage Fees. The Federal Home Loan Mortgage Corporation FHLMC commonly known as Freddie Mac is a publicly traded government-sponsored enterprise GSE headquartered in Tysons Corner Virginia.

Treasury Secretary Henry M. Over four days its available cash declined from 18 billion to 3 billion as investors pulled funding from the firm. In most of the US the 2022 CLL for one-unit properties will be 647200 an increase of 98950 from 548250 in 2021.

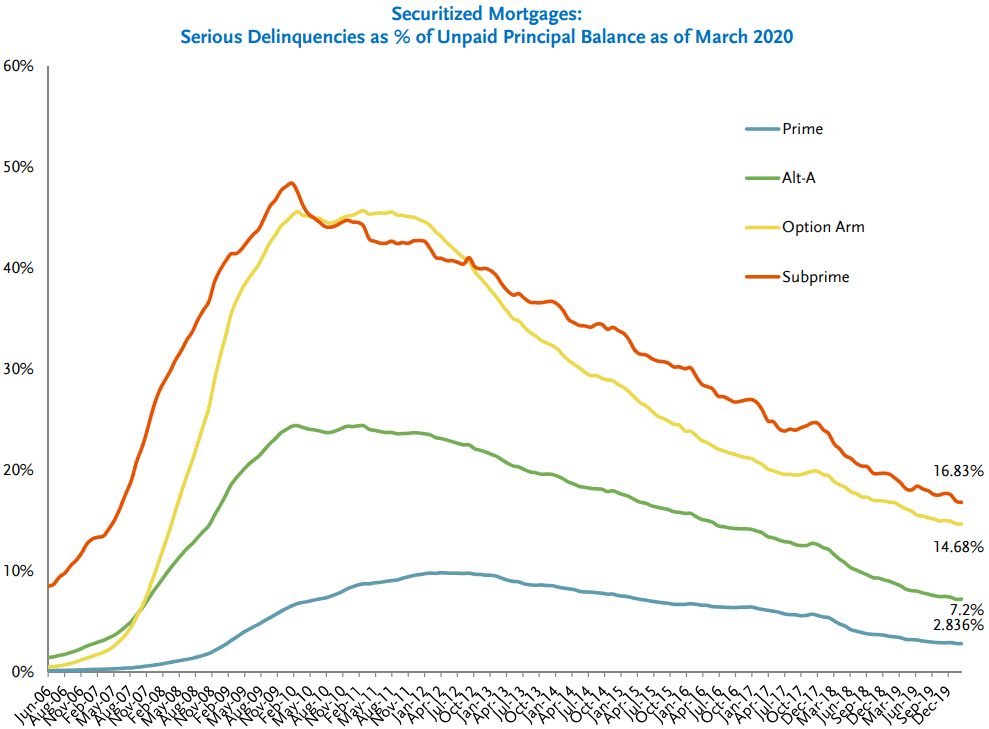

Losses were disproportionately worse during. It collapsed and was sold at a fire. Requirements vary but expect to need a credit score of at least 620-660 and a debt-to-income.

Of these Fannie Freddie held or guaranteed 12 million mortgages valued at 18 trillion. Understanding Mortgage Closing Costs. This number was more than double their market share before the 2008 crisis.

Fannie Mae and Freddie Mac Programs 3 Down. Fannie Mae and Freddie Mac the Enterprises were created by Congress to provide stability and liquidity in the secondary housing finance market. Army general officer to resign his commission amid his tour of duty in the 20th centuryWas he a patriot a madman or a little of bothWhat was his connection to Lee Harvey Oswald and the JFK assassination.

If the bump in the index was 6 the ceiling would rise by 18 to 764000. Read more about this directive. House of Representatives from Massachusetts from 1981 to 2013.

David Fulford Vice President Lender Strategy And Integration Freddie Mac Linkedin

Appraisal Waivers Almost 50 Of Fannie Freddie Loans Appraisal Today

Fannie Wants Desktop Appraisals With Floor Plans Appraisal Today

Appraisal Waivers Almost 50 Of Fannie Freddie Loans Appraisal Today

Mortgage Dreams Florida Home Facebook

What Are Pass Through Bedrooms For Appraisals Appraisal Today

A New Report Says That The Dissolution Of Fannie Mae And Freddie Mac The Two Largest U S Mortgage Guarantors Would Hav Fannie Mae Foreclosures Mortgage Tips

Calculated Risk February 2018

How Fannie Mae And Freddie Mac Work Fannie Mae Borrow Money Understanding

Mis 3090 It For Financial Services Real Estate And It August 27 Ppt Download

What Is The Difference Between The Kentucky Freddie Mac Home Possible And The Fannie Mae Home Ready Loan Program Fannie Mae Kentucky Home Loans

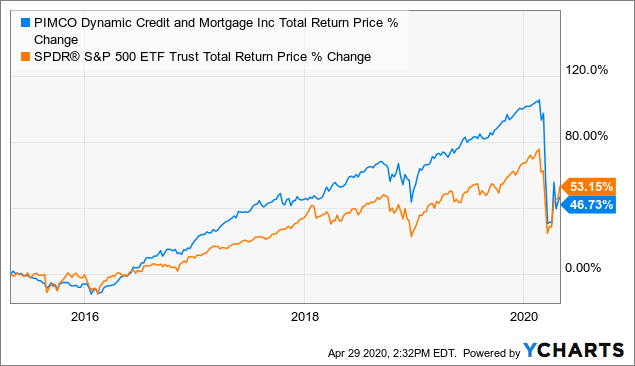

Pci Rare Double Digit Yields From An Elite Fund Nyse Pdi Seeking Alpha

Freddie Mac Short Sale Process Flow Chart Not Sure If You Have A Fannie Mae Freddie Mac Or Non Gse Loan You Can Process Flow Chart Flow Chart Process Flow

Desktop Appraisals Lots Of Info Available Appraisal Today

Decade After Housing Crash Fannie Mae And Freddie Mac Are Uncle Sam S Cash Cows Fannie Mae A Decade Boomtown

Appraisal Waivers Almost 50 Of Fannie Freddie Loans Appraisal Today

Pci Rare Double Digit Yields From An Elite Fund Nyse Pdi Seeking Alpha